Rental Development Growing Despite Softening Market Conditions

TORONTO – January 29, 2026: Urbanation Inc., the leading source of data and analysis on the Greater Toronto Hamilton Area (GTHA) condominium and rental apartment markets since 1981, released its Q4-2025 rental market results today.

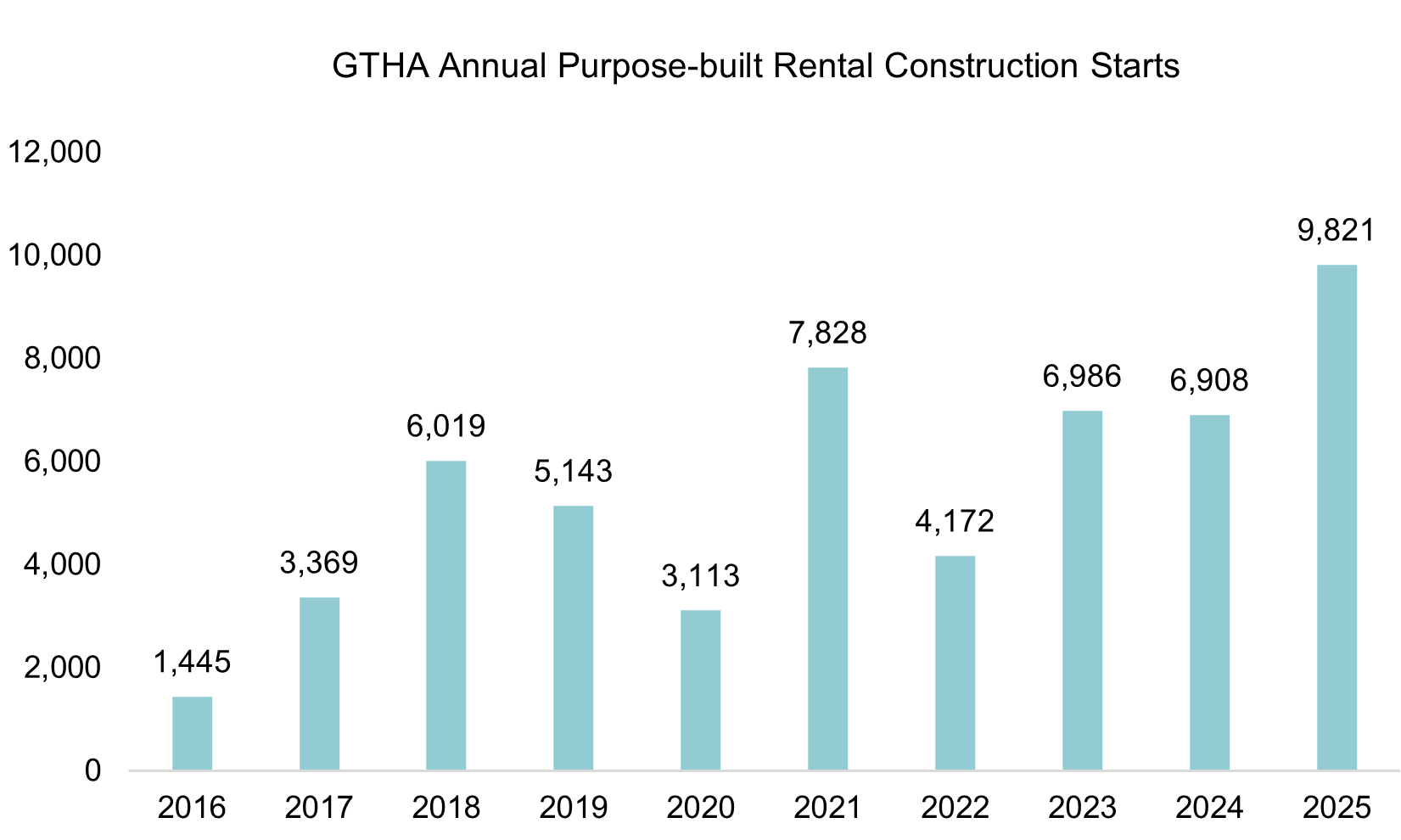

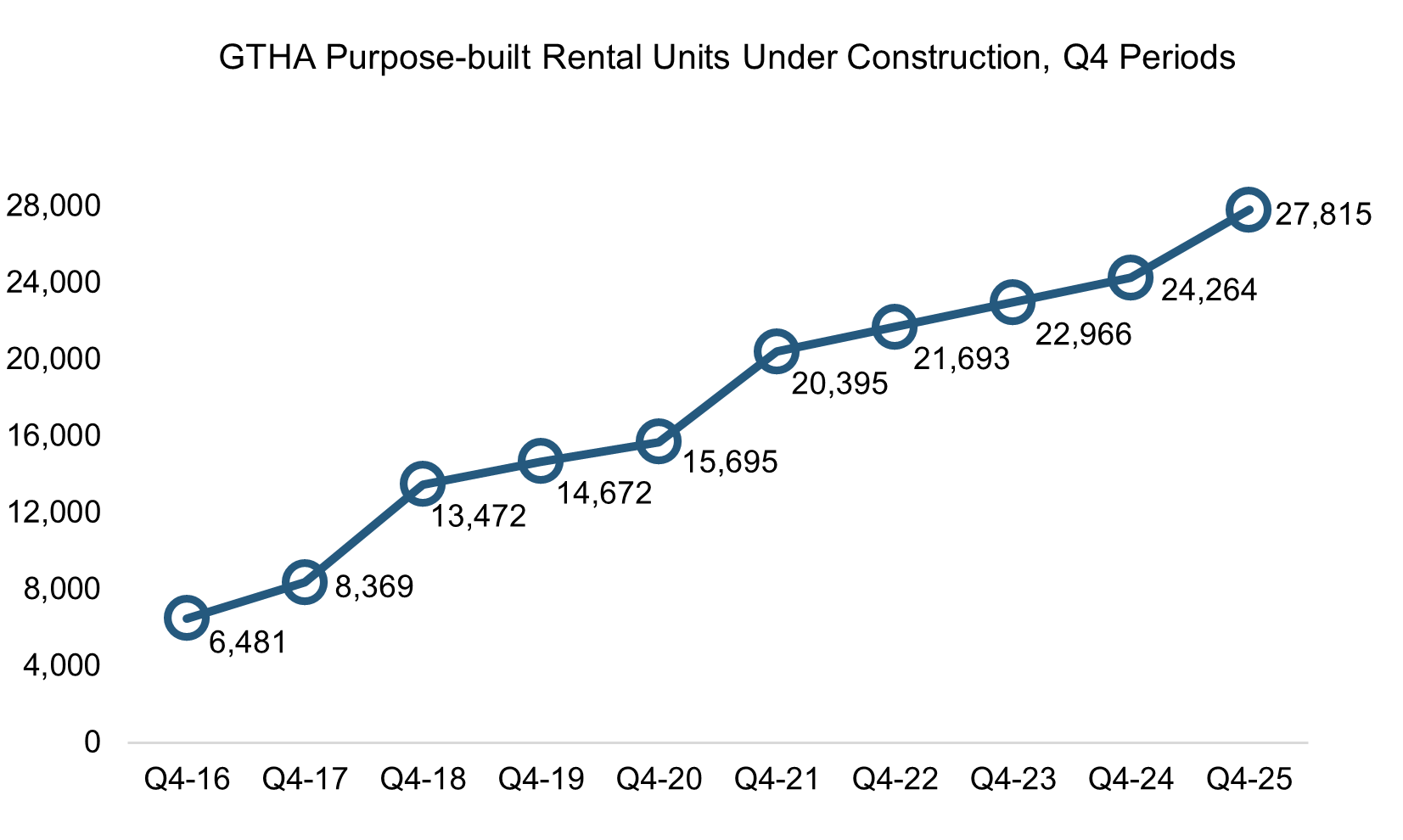

A total of 9,821 purpose-built rental units started construction in 2025, a 42% increase over the 6,908 units that started construction in 2024 and representing the highest annual total since the 1970s. As of year-end 2025, a total of 27,815 purpose-built rental units were under construction in the GTHA, rising 77% over the past five years.

Rental development activity ramped up in 2025 even as the rental market was at its weakest since the pandemic. The vacancy rate for buildings completed since 2000 was 3.7% in Q4-2025, up from 3.4% in Q4-2024 and the highest level since Q4-2020 (5.5%).

Purpose-built rental completions reached a more than 40-year high of 6,379 units in 2025, with more than half (59%) of these units still available for lease at year-end. There were 44 buildings still in their initial lease-up phase that had yet to reach stabilization (i.e. 95% occupancy), including 23 buildings completed in 2025, 14 buildings completed in 2024, and seven buildings completed in 2022-2023.

In addition to rising purpose-built rental supply, the easing in the rental market last year can be attributed to condo completions (about half of which are used as rentals) remaining near a record high, as well as population growth stalling, heightened economic uncertainty, and persistent affordability issues. Purpose-built rentals completed since 2000 that were available for rent during Q4 had average rents of $2,916 per month based on an average size of 720 square feet. This was down 2% from a year ago but remained 16% higher than five years ago.

To make rents more attractive to tenants, rental operators continued to offer incentives. Two-thirds of all buildings completed since 2000 offered some form of incentive in Q4, with two months of free rent becoming most common at 35% of all buildings. After adjusting for the value of incentives, average rents fell to $2,565, a 5.5% decline from incentive-adjusted rents in Q4-2024 ($2,713).

Purpose-built rentals faced increased competition from condo rentals, which saw rents continue to slide. Condo rents declined by an average of 4.0% during 2025, the steepest decrease since 2020 when rents fell by an average of 6.7%. This occurred even with a record high volume of condo lease transactions in 2025 at 64,531 units. Supply pressures prevailed as more investor-owned units hit the market, despite having deeply negative cash flow. For condo units completed in 2025, monthly ownership costs (including mortgage payments, condo fees and property taxes) were found to be $1,338 higher than realized rents.

“Some developers are looking past the current softness in the market by starting construction on new rental projects, with an understanding that conditions will improve in the years ahead as condo supply dries up. But even with rental starts reaching nearly 10,000 units last year, it won’t likely be enough to move the needle on improving affordability. The GTHA currently has over 150,000 approved rentals in the pipeline waiting to become economically feasible.”

Shaun Hildebrand, President of Urbanation

Latest Research

January 29, 2026

Nearly 10,000 GTHA Rentals Started Contruction in 2025January 21, 2026

New Condo Sales Fall for 4th Year to Lowest Since 1991November 4, 2025

Ottawa Rental Starts Reach Multi-Decade High in Q3October 28, 2025

GTHA Rental Projects Forge Ahead in Q3 Despite Declining RentsOctober 16, 2025

Condo Project Cancellations Hit Record High in Q3 as Sales Fall to 35-Year LowSeptember 11, 2025

The housing market – where are we?

In The News

January 23, 2026

“No New Condo Completions” In GTHA By Decade’s End: UrbanationJanuary 23, 2026

Toronto and Hamilton-area new condo sales in 2025 were the lowest in 35 years, says UrbanationJanuary 23, 2026

What might a condo market recovery look like?January 19, 2026

Real estate research firm Urbanation being acquired by software company RentsyncJanuary 13, 2026

Average asking rents fell every month of 2025, report saysNovember 26, 2025

Fewer Canadians think condos are a good investment, offering a silver lining for younger homebuyers