TORONTO – October 28, 2025: Urbanation Inc., the leading source of data and analysis on the Greater Toronto Hamilton Area (GTHA) condominium and rental apartment markets since 1981, released its Q3-2025 rental market results today.

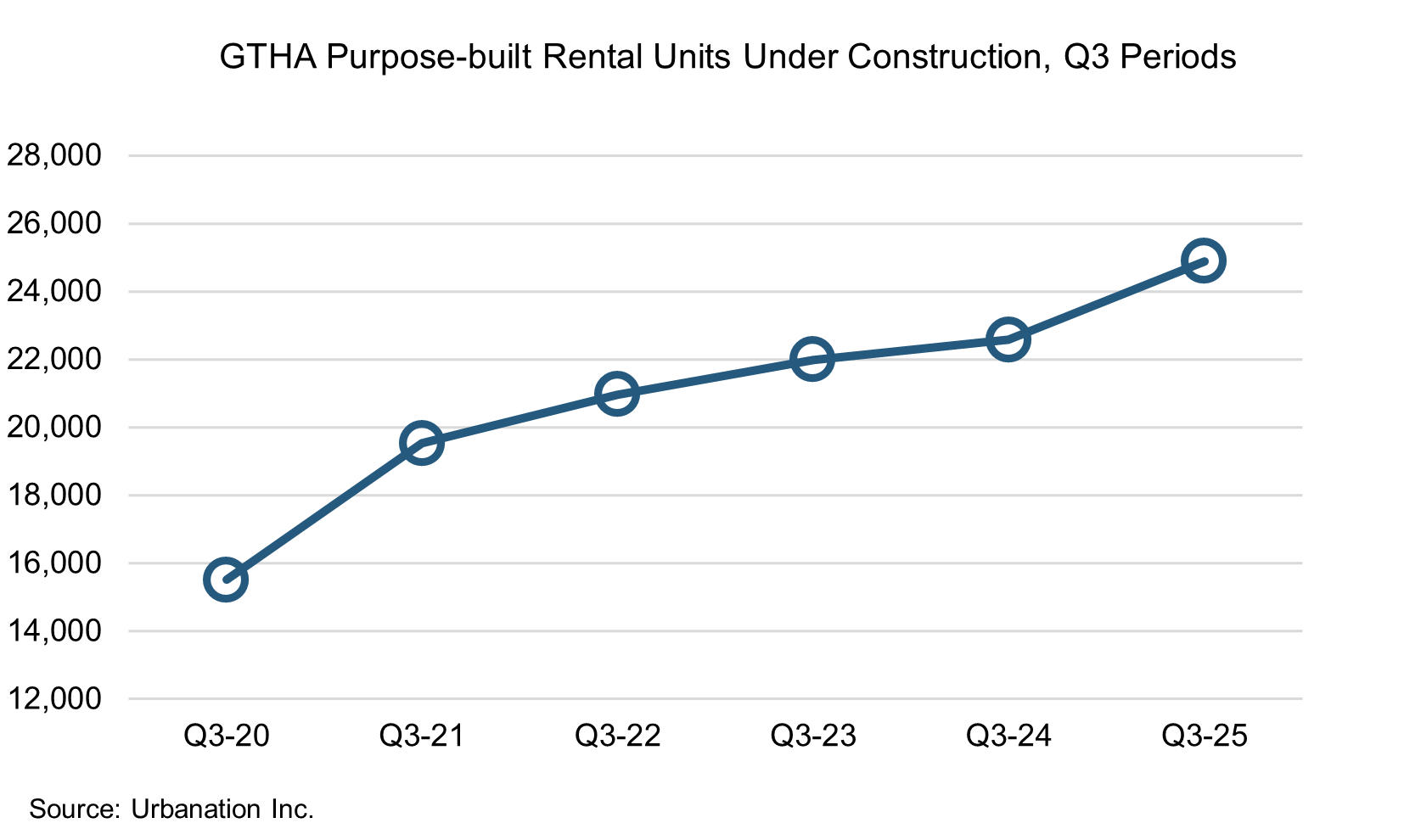

A total of 1,798 purpose-built rental apartment units started construction in the GTHA during the third quarter, increasing 25% from a year ago. This brought year-to-date total starts for rentals to 5,475 units — a 32% increase from the same period last year and the highest level since 2021. The 24,893 purpose-built rental units under construction in the GTHA as of Q3 represented the highest amount of new rental development underway in the past 50 years.

Furthermore, 50 new purpose-built rental projects totaling 18,570 units submitted development applications so far this year, a 69% increase from the same period last year. Additionally, many planned condo projects have pivoted to rental. A total of 27,320 units in 61 projects that previously submitted a condo development application have switched their application to purpose-built rental this year. This was in addition to the nine cancelled condo projects (1,778 units) that were in active development and switched to rental.

The expansion of future rental supply has occurred despite softer market conditions. In Q3-2025, the vacancy rate within stabilized purpose-built rental projects completed since 2000 in the GTHA was 3.5%, rising from 2.8% a year ago in Q3-2024 and nearly doubling from 1.8% two years ago in Q3-2023[1]. A total of 40 rental projects were in their initial lease-up period across the GTHA in Q3-2025, more than half of which (21 projects) began occupying more than 12 months ago.

Rents for units that were available to lease within purpose-built rental projects completed since 2000 across the GTHA averaged $4.05 psf ($2,885 for 712 sf) in Q3-2025, declining 2.6% annually. However, when factoring in incentives, which include free rent periods, average rents fell 6.0% over the past year. A 63% share of buildings offered incentives during the third quarter, including a 33% share offering two months or more of free rent — up from an 11% share a year ago. A 31% share of buildings offered one or one-and-a-half months of free rent, with other incentives including cash move-in bonuses, gift cards, and free or reduced parking and locker rentals.

In the secondary condo rental market, average rents declined 4.5% year-over-year in Q3 to $3.85 psf ($2,633 for 684 sf). Since reaching a record high two years ago in Q3-2023, condo rents have declined by a total of 8.3%. Studios experienced the largest decline in rents, falling 6.8% in the past year and by 13.7% over the past two years. In the City of Toronto, average condo rents declined 3.8% year-over-year to $4.02 psf ($2,714 for 675), compared to an annual decrease of 5.7% in the 905 Region to an average of $3.47 psf ($2,442 for 704 sf).

“With the condo market effectively on pause, developers have turned their attention towards purpose-built rentals. While it’s encouraging to see more rental projects getting underway, the level of rental construction activity in the GTHA is trailing behind other parts of the country and will not be enough to offset the supply shortage left behind by a lack of condo development.”

Shaun Hildebrand, President of Urbanation

[1] Vacancy is measured within stabilized buildings. A building is stabilized once it reaches 95% occupancy for the first time.

Latest Research

October 28, 2025

GTHA Rental Projects Forge Ahead Despite Declining RentsOctober 16, 2025

Condo Project Cancellations Hit Record High as Sales Fall to 35-Year LowSeptember 11, 2025

The housing market – where are we?August 20, 2025

GTA Rental Supply Gap to Double in Next 10 YearsAugust 14, 2025

Ottawa Rental Supply Spikes in Q2July 29, 2025

Two-Thirds of Rental Buildings Offering Incentives in Q2

In The News

October 17, 2025

Condo sales in Toronto, Hamilton fall to 35-year low in third quarterOctober 17, 2025

Toronto and Hamilton-area condo cancellations have hit a record high. Here’s how many have been cancelled this yearOctober 15, 2025

Developers of GTHA purpose-built rentals find it’s taking longer than ever to fill empty buildingsOctober 8, 2025

Renting? Report says Canada is at ‘best levels of affordability’ in 2 yearsSeptember 25, 2025

Condo To Rental Pivot Gains Momentum In GTA With ‘Big Behind-The-Scenes Push’September 12, 2025

Toronto preconstruction condos still too pricey for investors: report